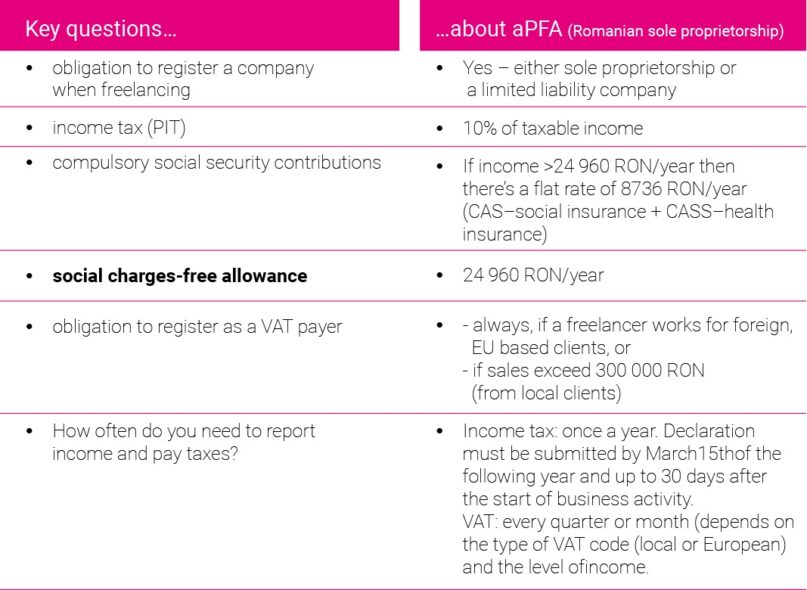

In this article, we discuss the legal and tax environment of Romania from the perspective of a remote employee. The latter is understood as a co-worker who is not bound by an employment contract with his/her employer. Some important questions that we answer are:

- are freelancers obliged by the law to register a business?

- how and when should income be reported and what are the tax rates?

- finally, is it a competitive system comparing it to the rest of Europe?

How many Romanians work remotely?

We’re talking about a medium-sized country, with 19.5 million inhabitants. More people living there are registered on freelancer websites than in large countries such as Germany, Poland or Italy. With 17,000 users of one of the most popular freelancers’ sites, the country climbed there to the 5th position in Europe.

We already published an article about the popularity of freelancing in Europe, in which you can see some interesting statistics.

Freelancer must register a business

Romanian law explicitly states that everyone with regular income (except for full-time employment) should register their gainful activity (Article 269 of the Fiscal Code). There are no flexible solutions, such as a contract of a result, as in the case of some other European countries, e.g. Bulgaria, North Macedonia, Germany, Poland, Finland, to name a few.

Go ahead and read more:

Freelancers’ taxes in Bulgaria

North Macedonia: tax obligations of freelancers

So you have to open a company. Freelancers have a choice of two rational options: self-employment and a limited company. Both solutions have their pros and cons. Let’s take a closer look at both of them.

Self Employment (PFA)

The simplest form of activity is a PFA (Persoana Fizica Autorizata), i.e. sole proprietorship.

Advantages of a PFA – simplicity

Taxes, accounting, and finances as such, are maximally simplified. We can freely dispose of company funds, i.e. you can withdraw any amount of money at any time and do not justify it with accounting documents. Accounting is almost as easy as noting transactions in a spreadsheet.

The advantages of a PFA include the simplicity of settlements with the tax office. It is enough to submit once a year (30 days from the start and then to mid-March for the previous year) the so-called “Declaratia unica”. So there is even no need to pay for the accountant’s services throughout the year if we are organized enough.

Income tax is only 10% and deductibles apply

The tax rate is 10% and there is no income-tax-free allowance. There is, however, a different threshold, connected to the obligation to pay social charges. Up to yearly income of 24 960 RON these charges are zero. In practice, if the income does not exceed the minimum salary, only income tax must be paid.

Disadvantages of a PFA – personal liability and flat charges

There are some costs for simplicity and flexibility. First of all, a self-employed person is liable for all his property for the company’s liabilities.

In addition, after exceeding the minimum income, one must pay pension and health contributions. They are fixed and have been set as 25% and 10% of the annual minimum salary respectively. In practice, the sum of charges in 2019 is RON 8736 / year (~ EUR 1800).

Income simulation for a PFA

Finally, let’s consider the case of a remote employee who earns average income in Romania (RON 3116 net monthly, or EUR 650). In addition, we assume that such a person works remotely using a computer, so the deductibles are low and amount to 20% of income (for the sake of simplicity).

In the case of a PFA, the annual sum of the charges will be ~ 11 100 RON, which accounts for 30% – so nearly a third part of the salary! It’s quite a number.

Are you interested in obtaining more information?

Would you like to learn more about Romanian limited company, including taxes, fixed fees, frequency of settlements with the tax office?

Download a full report about taxes for freelancers in Romania.

Are you thinking about hiring a Romanian freelancer?

Do you have a remote worker from Romania or are you pondering how to legally hire one? Consider Useme – with us the whole HR process is completely non-engaging and thus simple and trouble-free for both sides.

Propose your remote co-worker to issue an invoice as an individual or use our API to account a whole team of Freelancers. Useme will take care of the formalities, payment security, transaction history, file storage and more.

Any questions? Contact us at [email protected].