Wise vs. PayPal for receiving money – how do they work?

By using one of the platforms in question, you can expand your service across the globe – they both facilitate secure international transfers. Therefore, they’re widely used by freelancers and their clients. PayPal and Wise are usually cheaper than traditional bank transfers with high exchange rates.

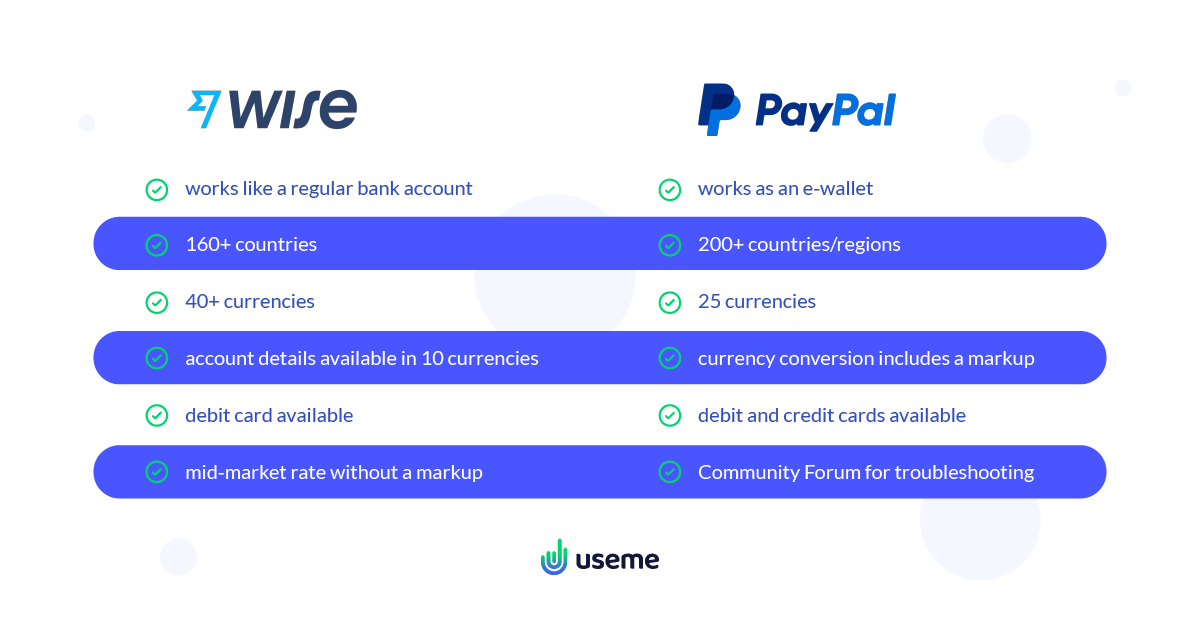

Wise works like a regular bank account and lets you do the same operations. Everyone who owns a Wise account can send payments to the recipient’s bank account directly. You can get account details in 10 different currencies. PayPal, however, provides you with an e-wallet. You don’t have a separate bank account but a PayPal account. It’s a popular and convenient way to shop online. A lot of online stores accept PayPal payments.

To receive money on Wise, you need to set up a free account and share details with your clients – they don’t need to have Wise themselves. You can use your Wise account for daily payments and operations – simply for everything.

With PayPal, it works differently. Both parties need to have a PayPal account to process the payment smoothly. Then, when freelancers receive the money through PayPal, they can send it to their bank account or use it for online payments. It’s possible to send money from PayPal directly to bank accounts using Xoom – a service owned by PayPal.

Let’s look at each international money transfer service from various angles to compare Wise and PayPal. Although both platforms offer business and personal accounts, our main focus will be the personal one.

How much will you pay – international transaction fees

In Wise and PayPal, there’s no setup or monthly fees – the personal account is free. Both money transfer services charge currency conversion fees, which depend on different factors.

Wise fees

You can open a personal account with details in 10 currencies: AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, TRY, and USD. Receiving money in these 10 currencies doesn’t include any fee from the recipient (for USD, only non-wire transfers are free to receive). It works as a regular bank transfer.

To send money abroad from a Wise account, the sender has to pay a relatively small currency conversion fee depending on the currencies – it starts from 0.4%. You can check the overall cost of converting and sending money in the Wise calculator – choose the location in the top-right corner.

Another fee stems from the transfer time. For some currencies, users choose between low-cost transfer from a bank account (the cheapest), easy transfer through online payment, and fast transfer from a credit or debit card (the most pricey and the fastest).

Wise offers a debit card for a one-time fee of 7 EUR with limited free withdrawals and withdrawal amount. You can check the details of your preferred currency on their pricing page. When you exceed this amount or the number of free withdrawals, a percentage fee will apply.

As we mentioned, Wise deducts a small percentage from every conversion on your account. The fee depends on the currency. To receive the exact cost of exchange, check their latest fees for converting money.

PayPal fees

To send and receive money through PayPal, both parties must have active PayPal accounts or use a third party authorized by the service. Sending international personal transactions requires the user to pay a fee based on the transaction amount and the country to which we’re sending the money.

To learn more about fees charged by PayPal, visit their website – to change the region, scroll to the bottom of the page, click on the flag and select the region, scroll down the page again, and click on Fees.

PayPal and Wise as payment options in Useme

As a freelancer registered in Useme, you can settle deals with clients from all around the world. To do so, you need to choose a preferred payment option for each currency. Wise and PayPal are available for freelancers who make deals with international clients through Useme.

How do you receive the payment from your client through Useme? We send you the gross amount that’s stated on the invoice. We don’t deduct any taxes, and you don’t need to pay additional fees for using PayPal or Wise. What you do need to pay later on is the cost of the exchange if you want to convert the currency of your pay or the cost of sending money to a bank account – but that’s up to you.

Exchange rates

Many freelancers question joining the global talent pool due to unfair currency rates offered by banks. Services like Wise and PayPal solve the problem since their competitive exchange rates are usually smaller than your local banks’. Here’s how each platform handles currency exchange.

Wise

Wise boasts their transparent fees and favorable exchange rates. And they have every right to do so – there are no hidden fees and markups to currency conversion. They use tiny conversion fees and a fair mid-market exchange rate, which is the rate you see when you check currencies on Google. You can use their currency converter and compare the result with other providers.

PayPal

To check how much exactly it will cost you to exchange money, you can use PayPal’s currency calculator, which is available only through your PayPal account. They claim that their currency conversion fees remain competitive with those used by banks. However, they add a percentage fee to the mid-market rate.

Locations and currencies

Both services are available in multiple countries and currencies.

Wise international payments

It’s offered in more than 160 countries and supports 40 currencies. You can find a list of countries where Wise doesn’t provide service. Mind that the list of 160+ countries where Wise is available isn’t the same as the list of countries you can send the money to with Wise. Find the latter here.

PayPal international payments

PayPal is accessible in more than 200 countries/regions and supports 25 currencies. Check the countries and currencies covered by PayPal.

Compare Wise and PayPal – transfer time

Wise vs. PayPal for receiving money – which is better in terms of speed? Let’s see.

Wise

When you set up a transfer, you’ll see how long it will take. It depends on four things: the countries you’re sending the money from and to, the payment method, the hour of the transfer, and extra security checks. In some cases (e.g., European currencies, GBP), you can choose between Fast, Easy, and Low cost transfers – each takes a different time.

PayPal

PayPal transfers between two PayPal users are processed instantly. If later on you want to transfer money to your bank account, you will have to wait longer or pay a fee for a faster withdrawal. PayPal claims that the timeframe for transferring money depends on the selected transfer type (Instant Transfer – max. 30 minutes or Standard transfer – usually 3-5 business days or 48 hours to your eligible card)

Payment options – Wise vs. PayPal for sending money

Both transfer services offer convenient payment options.

Wise

Each payment option has a different fee and transfer time. Bank transfers directly to the recipient’s account are the most popular and usually the cheapest, but they’re slower than debit or credit card payments. You can also send money internationally with Google Pay and Apple Pay. Under certain conditions, paying by POLi and your connected bank account (ACH) is also possible.

PayPal

Like Wise, PayPal enables users to do bank transfers and to pay by credit and debit cards. Two PayPal users can send money to each other using PayPal balance.

Accessibility and customer service

Both platforms have websites in multiple languages and provide iOS and Android apps. The apps receive good reviews, scoring above 4 in both Google Play and App Store.

PayPal and Wise have elaborate Help Centre with detailed answers to the most common questions. Let’s further compare Wise and PayPal in terms of customer service:

Wise

Apart from using their Help Centre, you can reach Wise by phone and email. To send a message, you first need to sign up. To contact them without setting up an account, use their European phone number: +44 203 974 1320, available from Monday to Friday, from 8 am to 4 pm.

PayPal

Being enormously popular worldwide, PayPal has a Community Forum where you can troubleshoot with the help of other users. If you want to message PayPal’s customer service, you need to log in. For some countries, PayPal offers a helpline to use without having an account. Go to the Help tab and scroll down to see contact options.

Security in PayPal and Wise

Both platforms protect their users’ accounts and money. They’re fully licensed and regulated, so sending and receiving money domestically and internationally is safe. Below are some features dedicated to ensuring security.

Wise:

- two-factor authentication,

- data protection,

- vulnerability reporting,

- secure communication code (protection against phishing),

- fraud team.

PayPal:

- two-factor authentication,

- reporting PayPal imposters,

- reporting fraud or unauthorized activity.

PayPal provides valuable tips on protecting your personal information, applicable not only to this service but also to general internet use.

Wrap-up: Wise vs PayPal for international money transfers

No matter if you choose PayPal or Wise, you win. How?

- Both PayPal and Wise offer lower exchange rates than traditional banks, so you avoid spending extra money on a high currency exchange rate. This way, you can offer freelance services and fair international payments to clients from other countries. More countries, more clients, more assignments, more money – it simply pays off. For more budgeting tips, check our latest ebook, Cash Flow Management for Freelancers.

- You can treat PayPal or Wise account as your piggy bank. Having a separate account for payouts will help you track your finances, put aside some savings, and manage spending.

- You can use Wise and PayPal payments in Useme. Here, you can invoice your domestic and foreign clients without opening a company. After delivering the assigned job, we’ll transfer your pay to your PayPal or Wise account. You receive the gross amount from the contract without any deductions (such as tax or social security).

Visit Wise and PayPal, set your location, and read more about pricing, multi-currency accounts, and extra features.