Hi, Szymon. We’re grateful you could join us for this interview. Let’s get going. Why, in your opinion, might invoicing without having a registred company raise doubts?

Hi! We often think that only registered companies can issue invoices. However, there are legal ways to issue invoices without setting up a business. Useme is one of them. To understand how it’s possible and how it works, we need to analyze the process from Useme’s perspective.

Thanks to it’s business model, Useme can enter into an online contract with a freelancer and resell their work to their client. As a result, two registered businesses – Useme and the final client – make a purchase-sale transaction. Since Useme is a company, we can invoice the client for the freelancer’s work.

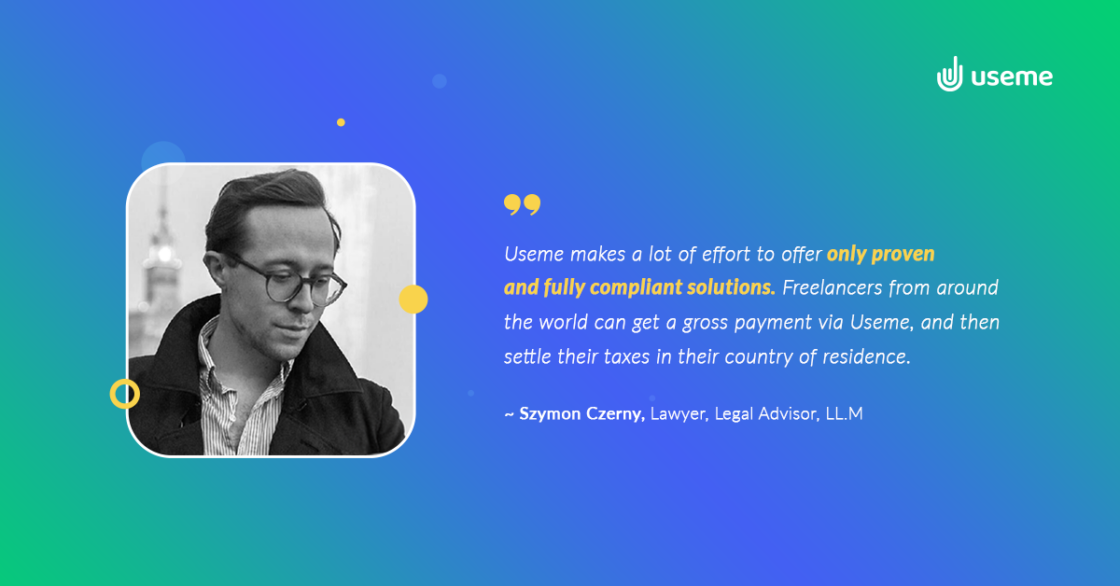

How does Useme ensure tax compliance across different countries?

We make an effort to stay on top of legal and tax regulations and to constantly improve our services. While in some countries, we support our freelancers by withholding and paying their taxes directly to the tax authorities, in the majority of countries where Useme operates, the freelancers receive a gross payment via Useme, and need to settle their taxes in their country of residence on their own.

The contract with a freelancer is made online. Useme doesn’t require them to print documents, send a signed agreement, or deal with other red tape. Despite all that, Useme is legit. How’s that?

Generally speaking, thanks to contractual freedom, national laws in most countries don’t specify how contracts should look. Therefore, the contract between freelancers and clients will not necessarily require any specific form to be valid and produce legal effects for both parties. Moreover, it’s legal to enter into such a contract online, e.g., via email.

How can you enter into a contract via Useme step by step?

A freelancer who wants to settle a deal with a client needs to provide all the necessary details which will be used to draft a contract via Useme. Then, Useme verifies the details as specified in the freelancer’s offer. Once approved on our side, the offer is sent to the client together with a deposit invoice.

When the client accepts the freelancer’s offer, they must pay the deposit invoice received from Useme. Paying the deposit invoice means that the client accepts Useme’s terms and conditions and confirms the deal. Once we receive the payment, we notify the freelancer and order them to proceed with the job according to an agreed deadline.

Can the freelancer and the client refer to their arrangements made via Useme?

Yes, they can. Freelancers and clients communicate with each other on Useme. We archive all the messages and files sent through our platform, so it’s easy to prove that the job has been completed. We also save all the system messages and files with the freelancer’s work. Every transaction ends with a confirmation sent to both parties.

How about transferring copyright?

Useme lets its users freely dispose of the copyrights to the work created as a result of the job being completed. The client can ask the freelancer to grant a license to use the work or to transfer the copyrights to the work. Neither licensing nor transferring copyrights via Useme doesn’t require a written contract.

Recently, Useme has made it easier to transfer copyrights without printing, signing, and scanning documents. This process uses qualified electronic signatures and other legal solutions. Useme generates an electronic document to confirm granting the license or transferring the copyrights. In case of copyrights assignment the copyrights are transferred first to Useme and then to the client.

Thank you Szymon for your time!